Trusted by Industry Leaders Worldwide

Proven Results. Real Impact. Global Reach.

Helping businesses grow with secure, scalable, & reliable branded digital payment platforms.

0K+

Customers achieved

by our clients

0+

Paytech leader

partnerships

0+

Countries

served

Delivering digital payment solutions for a wide spectrum of industries

Banks & neo banks

Deliver omnichannel customer experiences along with a secure payment infrastructure.

- Enable faster go-to-market with a ready fintech infrastructure.

- Simplify compliance with integrated KYC, AML, and fraud modules.

- Expand customer base through branchless and agency banking models.

Telcos

Tap new revenue streams offering bill payment, TV subscription, & more with digital wallet.

- Monetize existing customer base with mobile-money ecosystems.

- Integrate airtime, bill pay, and wallet services seamlessly.

- Drive financial inclusion in underbanked or rural regions.

NBFI

Enabling complete real-time payments interoperability with our trusted digital wallet solution.

- Digitize lending and collections with secure payment rails.

- Offer agent-led deposits, disbursements, and repayments.

- Enhance customer experience with instant digital onboarding.

Fintech

Power your fintech with agile, scalable, and fully branded digital payment solutions.

- Launch wallet, card, or remittance solutions in weeks.

- Scale securely with PCI-DSS, GDPR, and ISO-ready systems.

- Customize modules to fit unique product or market needs.

MTOs

Enable secure, fast, and compliant cross-border payments with white label remittance solutions.

- Manage multi-corridor transfers with smart routing and FX control.

- Track inbound remittances in real time with transparency.

- Reduce operational costs through automated AML screening.

Government

Digitize public disbursements & promote inclusion with secure digital payment platforms.

- Deploy subsidy, pension, or welfare disbursements digitally.

- Increase transparency with auditable, traceable payment flows.

- Strengthen citizen onboarding with verified eKYC processes.

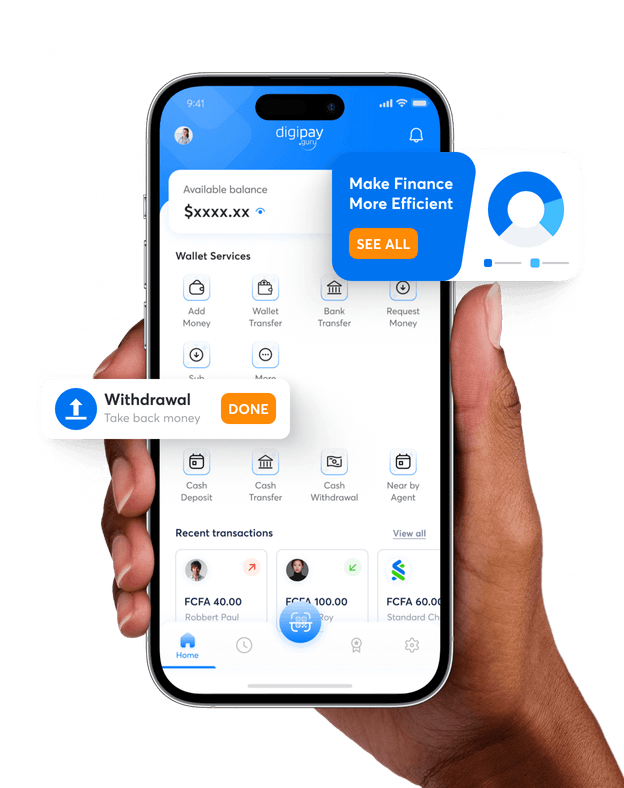

DGPay+: digital payment platform

A comprehensive suite designed to drive financial inclusion & cashless adoption. Our ROI-centric next-gen digital payment platform is armed with highly customizable features that support every business model. It’s the one solution to revolutionize banking in underserved markets, help financial companies build more mature, flexible, and future-proof digital platforms.

Explore DGPay+ solutionsExperience the Power of a White Label Digital Payment Solution Built for Growth

Get Started With a DemoMobile money

Empowering financial and non-financial institutions with our top-class mobile wallet solution to allow their customers to securely send, store, and receive money instantly at a fingertip.

Merchant acquiring

Simplify payment acceptance across industries with features like QR payments, tap-to-phone, and invoice management — all through a powerful, white-label merchant acquiring platform.

International remittance

Allow your customers to make instant international transfers without any waiting period, at most competitive forex rates, absolutely paperless, instant transfers at competitive fees.

Prepaid cards

Easily issue, activate and manage your prepaid card programs with security and convenience. It's user friendly, simple, accessible, and scalable for all.

eKYC

Effortless onboarding. Secure verifications. Accelerated growth. A perfect eKYC solution for streamlined compliance and seamless integration, ensuring ongoing success.

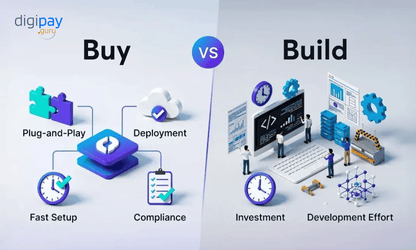

Why Leading Fintech Brands Choose DigiPay.Guru?

Fully Compliant & Secure

Our digital payment software is PCI DSS and GDPR compliant, with built-in AML and eKYC tools.

10x Faster Go to Market

Launch your white label digital payment platform in weeks with our ready-to-deploy infrastructure.

Complete Brand Ownership

Offer a fully branded experience with your own white label digital wallet, apps, and dashboards.

Insights That Shape the Future of Digital Payments

Get insights into how an automated eKYC solution can overcome traditional KYC challenges and make customer onboarding seamless, secure, and reliable for your business.

The Shift from Physical to Digital

- The global impact of remittances

- The evolution of cross-border remittances

- The current international remittance landscape

A comprehensive guide to digital wallets

- Background and history

- Wallet models

- Advantages of digital wallets

Transforming the retail landscape with prepaid card solutions!

- Retail and prepaid card overview

- Challenges faced by the retail business

- Overcoming the challenges with prepaid cards

Agency Banking in East Africa

- Insights into the global banking market

- The banking challenges & opportunities in East Africa

- Top agency banks and successful fintechs

What our clients say

DigiPay.Guru has consistently achieved success in delivering tailored and exceptional digital wallet solutions for its clients. Have a look at some of the client testimonials.

DigiPay.Guru team helped my team improve mobile money payments in South Africa. They are great to work with and delivered the best solution. We are really happy with the solution and would hire them again for our next project.

Essa Tarawally

Operations Manager, GambiaDigiPay.Guru’s success over the years

Over the years, DigiPay.Guru has successfully delivered several customized and top-notch digital wallet solutions for its clients. You can get a glimpse of a few of those works here.

How DigiPay.Guru Helped Launch a Scalable eWallet Solution for Financial Aid in Qatar

TAQAT is building a purpose-driven eWallet platform for Qatar Charity with the goal of modernizing how financial assistance is managed and distributed.

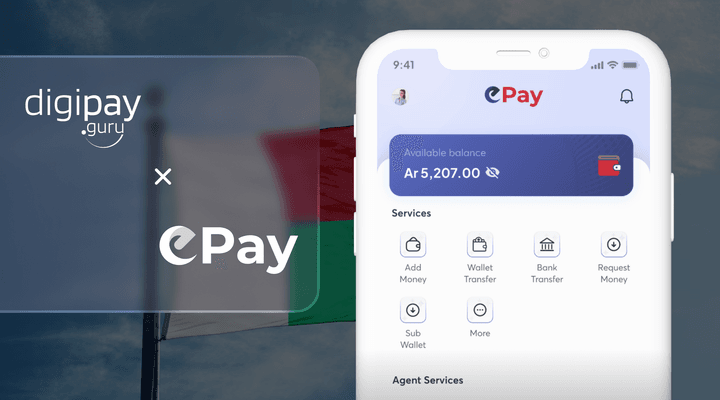

How a FinTech in Madagascar Launched a Compliance-Ready Digital Wallet in Just 15 Days

BlueLine is a financial services provider in Madagascar committed to delivering secure, intuitive, and user-friendly digital wallet experiences

Purposeful presence of DigiPay.Guru at enlightening FinTech Events

DigiPay.Guru was the frontier in 2021 as a FinTech expert and exchanged dialogues on digital payment existence and future. We are excited to participate in more upcoming events to assess the latest innovations that will underpin the next phase of transformation into the finance industry.

Frequently asked questions

DigiPay.Guru combines deep fintech expertise with a future-ready technology stack. Key reasons to choose us include

- End-to-end digital finance capabilities

- Highly customizable and white-label-ready

- Designed for low-bandwidth, unbanked-first markets

- Fast go-to-market deployment

- Modular architecture with full API library

- Robust compliance and security protocols

- Plug & play solutions & modules

We empower banks, fintechs, financial institutions, telecoms, MTOs, and related businesses to launch innovative financial services swiftly and reliably.

Security is a top priority at DigiPay.Guru. Our platform includes:

- End-to-end encryption

- Multi-factor authentication (MFA)

- Tokenization

- Role-based access control

- Compliance with PCI-DSS, GDPR, and local regulatory frameworks

- PCI SSF, SOC (Type 1 and Type 2), and ISO 27001 certified

- Regular security audits and penetration testing

- Advanced infrastructure security and much more…

We ensure your data and transactions are protected using enterprise-grade security protocols.

We provide comprehensive post-deployment support, including:

- 24x7 technical support

- Dedicated project and success managers

- Hands-on training sessions (on-site or remote)

- Knowledge base access

- Ongoing updates and enhancement cycles

Look through your eyes of insight to our insightful thoughts

DigiPay.Guru is born to simplify financial transactions. We love discussing the latest finTech solutions. We write regular blogs where we cover insightful topics with our insightful thoughts to cater you with imperative informations.

Empowering Payments Across the Globe

United States

Philippines

Somalia

Bahamas

Papua New Guinea

Haiti

Bangladesh

Angola

Guinea

Bermuda

Iraq

Senegal

Burundi

Colombia

Cote dlvoire

United Kingdom

Gambia

Madagascar

Cameroon